Financial Security for All

Financial inclusion empowers individuals and businesses by providing them with access to a wide range of affordable and essential financial services. These services encompass a spectrum of needs, from everyday transactions and payments to crucial avenues for savings, credit, and insurance.

Unrestricted access to these financial tools significantly enhances daily life. It empowers families and businesses to effectively plan for both long-term aspirations and unforeseen emergencies. By becoming accountholders, individuals are more likely to embrace other financial services, such as credit and insurance. This expanded access fosters entrepreneurial growth, facilitates investments in education and healthcare, strengthens risk management capabilities, and enhances overall resilience in the face of financial shocks.

Financial inclusion is widely recognized as a cornerstone for achieving sustainable development. It plays a pivotal role in advancing 7 of the 17 Sustainable Development Goals. The G20 has made a firm commitment to advancing financial inclusion globally, reaffirming its dedication to implementing the G20 High-Level Principles for Digital Financial Inclusion. Furthermore, the World Bank Group underscores the critical role of financial inclusion in alleviating extreme poverty and fostering shared prosperity.

Trends Shaping Financial Inclusion

In the recent past, several trends are shaping the narrative around financial inclusion. The pandemic may have been one of the most prominent. The COVID-19 pandemic accelerated the adoption of digital financial services in developing countries. Governments worldwide implemented emergency financial assistance programs, many leveraging digital payment channels to reach citizens quickly. A World Bank analysis found that at least 58 developing countries utilized digital payments for COVID-19 relief, with 36 countries directing these funds to accounts enabling savings, transactions, and withdrawals. This functionality is crucial for fostering financial inclusion.

The pandemic significantly boosted digital payment adoption in low and middle-income economies. Over 40% of adults in these regions made their first in-store or online merchant payments using digital methods since the pandemic’s onset. Similarly, more than a third of adults in these economies paid a utility bill directly from a formal account for the first time. India witnessed a remarkable surge, with over 80 million adults initiating their first digital merchant payment. This trend was even more pronounced in China, where over 100 million adults embraced digital payments during the pandemic.

Emerging technologies are transforming financial inclusion in emerging markets. Mobile banking, a key driver, enhances accessibility for underserved populations. Digital wallets and blockchain, including cryptocurrencies, offer diverse and innovative financial solutions, increasing inclusivity and providing greater choice.

Driving Financial Inclusion

Since 2010, a significant global effort has emerged to expand access to financial services. Over 55 countries have made formal commitments, and more than 60 are actively developing or implementing national strategies to achieve this goal. Countries that have made the most progress toward financial inclusion share several key characteristics. They have implemented large-scale policies, such as establishing universal digital identity systems, leveraging government payments to incentivize account opening and fostering a thriving mobile financial services ecosystem. These nations also actively embrace innovation, such as utilizing e-commerce data to enhance financial inclusion.

Furthermore, successful countries have also adopted a strategic national approach. They have developed comprehensive National Financial Inclusion Strategies (NFIS) that bring together diverse stakeholders, including financial regulators, telecommunications providers, and education ministries. Simultaneously, they prioritize consumer protection and financial literacy programs to ensure responsible and sustainable access to financial services.

The World Bank Group’s Financial Inclusion Support Framework (FISF) also play a vital role in accelerating and enhancing these national efforts. Launched in 2013 with funding from the Netherlands and the Bill & Melinda Gates Foundation, FISF aims to catalyze private sector investment in financial services; promote innovation in financial product offerings; expand access to a comprehensive range of financial services, including payments, savings, insurance, and credit, for the underbanked and unbanked, particularly low-income individuals and micro, small, and medium-sized enterprises.

Financial inclusion is not merely a social justice issue but a critical driver of economic growth and development. By leveraging technology, fostering inclusive policies, and promoting responsible financial behavior, we can empower individuals and communities to build a more prosperous and equitable future. Continued collaboration between governments, the private sector, and international organizations is essential to overcome the barriers to financial inclusion and ensure that everyone has the opportunity to participate fully in the global economy.

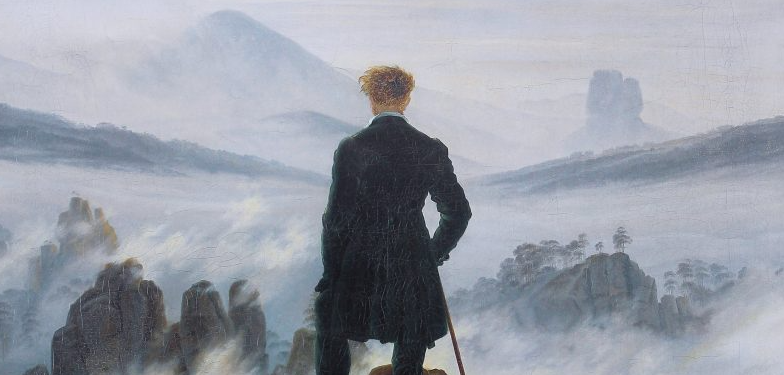

Photo Caption: Unrestricted access to financial tools significantly enhances daily life.