Can Asia’s Leaders Safeguard Multilateralism?

In the events leading up to the Global Financial Crisis (GFC) of 2008-09, open markets and economies were the order of the day. Much policy talk still centered on eliminating trade tariffs and efforts were directed at making cross-border trade even more seamless back then. The global financial markets were on a roll, and the prospects of the world economy looked bright. Until they didn’t.

The GFC led to substantial turmoil in the global economy and financial markets, and finally, after a period of great economic uncertainty, things seemed to be returning to normal. But the stabilization of the global economy also masked rising undercurrents of suspicion around free markets, and a growing number of people began questioning globalization.

By the time the dust had settled, the world was increasingly confronted with national leaders tending to look inwards and building walls, rather than bringing them down. This manifested in many forms around the world, and particularly in a few large developed economies.

One manifestation was the US withdrawal from the Trans-Pacific Partnership (TPP), which was initially backed by President Barack Obama, and would have resulted in the creation of the world’s largest free trade deal, representing around 40 percent of global gross domestic product. The second manifestation continues to play out even three years after the shock Brexit vote, and in some ways, calls into question the stability of the European project.

More broadly speaking, things seem to have come to a head over the past 3-4 years with national polities veering to either end of the political spectrum, resulting in a far different scenario than anyone envisaged prior to the GFC. Certain leaders have drummed up nationalistic fervor, suggesting that “unfair” international trade has resulted in economic deterioration and even hardship.

The trade conflict between the world’s two largest economies has grabbed headlines with the US administration ratcheting up tariff-related rhetoric and indeed increasing tariffs on Chinese imports, and China responding in kind. There seems to be a pause at the moment, and one hopes the two economies realize how their actions can plunge the global economy into a prolonged economic slowdown. And it isn’t just China on the receiving end – US trade with other countries is also being re-looked at.

Asian Economies Eager to Embrace Multilateralism

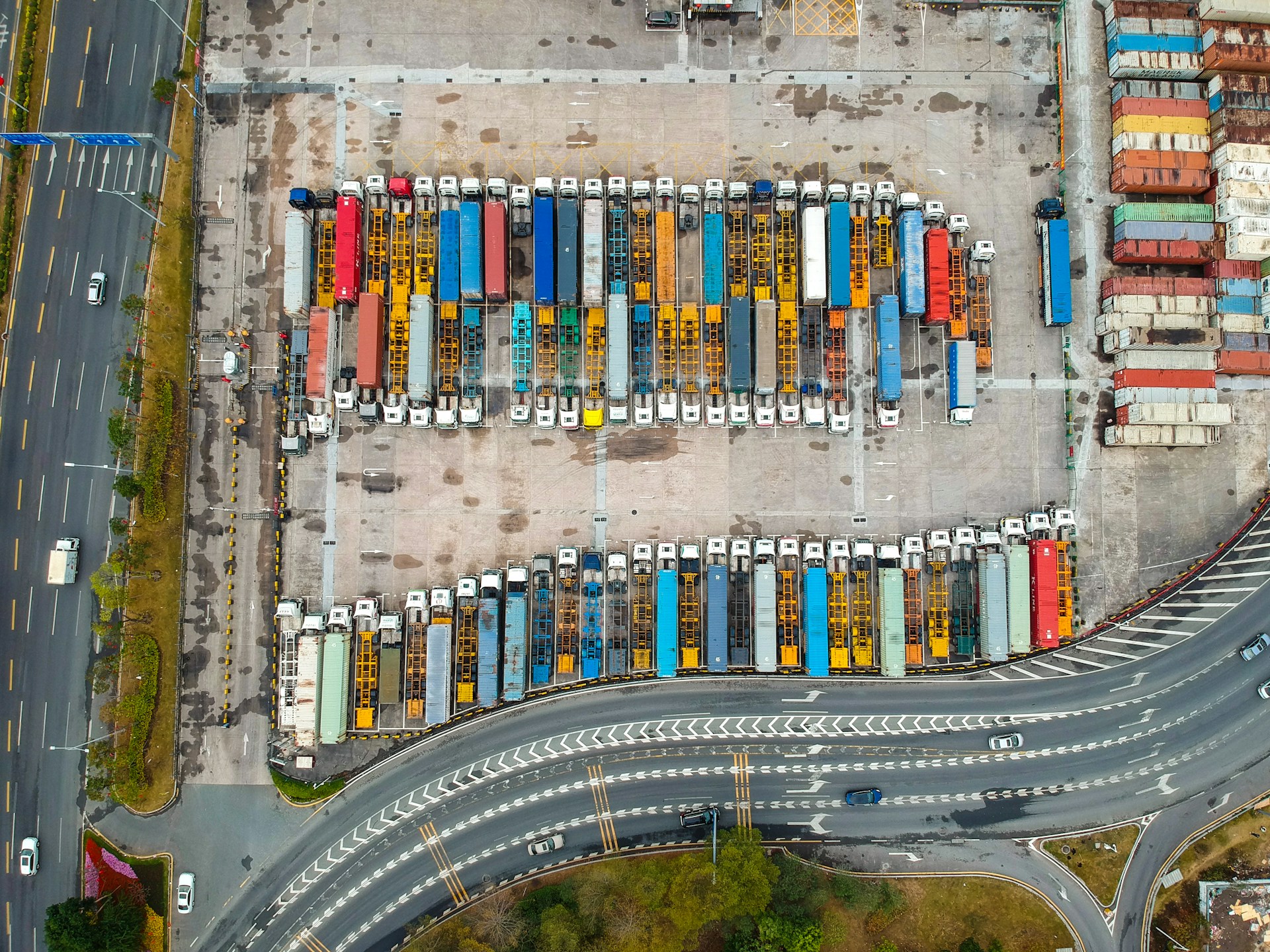

Even in the face of nationalist rhetoric—and in some instances, even action—Asian economies have remained resolute in their march towards multilateralism and free trade. The TPP has progresses without the US, driven by several Asian signatories to the agreement. Perhaps as importantly—at least symbolically even if not in terms of the quality of the trade deal—the Regional Comprehensive Economic Partnership (RCEP) is in the works. The RCEP is a proposed free trade agreement comprising 16 Asian countries – the 10 ASEAN member states and Australia, China, India, Japan, South Korea and New Zealand. When it does come into effect, it will be the largest free trade bloc in the world, covering close to half the world’s population and a third of global GDP.

The RCEP is expected to be formalized by end 2019 and if successfully implemented, will further embellish the Asian economies credentials as torchbearers for multilateralism and globalization.

Meanwhile, the ASEAN remains a bright spot for global economic growth. And efforts, while slow, remain underway to create a single market and to seamlessly connect all 10 member economies with the creation of necessary infrastructures.

Outside of trade, Asian economies have endeavored to create financial buffers and mechanisms to better meet their infrastructure and broader development needs. Asia-led institutions such as the Asian Infrastructure Investment Bank and the BRICS New Development Bank have been established to help meet the region’s financial needs.

The Chiang Mai Initiative Multilateralization (CMIM) has been set up to address short-term liquidity challenges in East and Southeast Asia. The Asian Financial Crisis of 1997 had a crippling impact on economies in the region, following which a financial safety net was deemed necessary. They chose to build a homegrown financial safety mechanism. Currently, this initiative has the potential to facilitate the coordination of national policies and multilateral structures.

These are a few initiatives that illustrate how Asia is moving ahead with multilateralism, enhancing cooperation with international institutions and mechanisms while also creating its own mechanisms of cooperation and collaboration.

In Stark Contrast

These moves are in stark contrast to what we are seeing in several developed economies in the West. The US, which has traditionally been seen as the most vocal proponent of free market economics, seems to be retreating aggressively from this position. Across the Atlantic, in the case of the UK, the country stands divided over its decision to leave the EU. While the UK continues (failing) to decide how best to structure the Brexit, the possible repercussions of this planned exit are already beginning to be felt.

Isolation is not a solution to solving domestic economic woes – it is more a political tool to influence voters for electoral gains. The continued success of Asian economies demonstrates the gains that trade and investment can bring. The world is ever more connected, and withdrawing into an isolationist shell is nothing but a shot in the foot.