Economics and Finance Outlook: The Background Music has Changed

“Even though a majority of institutional clients think we’re probably going to be in a recession, they don’t seem to be afraid of it,”

Mike Wilson, the Chief US equity strategist of Morgan Stanley, speaking on CNBC

“It is less bad than we feared a couple of months ago.”

Kristalina Georgieva, Managing Director, IMF

As we entered 2023, there was a feeling amongst many commentators that surely things cannot get any worse? Many forecasters, economists and pundits in writing their outlook for 2023 anticipated things might actually go right for a change. Investors are no exception. In fact in a recent Bloomberg News Survey of investors, 71% of respondents forecasted that stocks would rise, versus a mere 19% who expected a decline.

Risk assets, such as stocks, have indeed been rebounding. 2022 was one of the largest outliers in market history with the classic 60/40 stock/bond portfolio falling 24%, the most since 1930. So a rebound would not be a surprise with valuations having fallen, talk that inflation has passed its peak, the Chinese engine of growth being restored to the global economy with the end of their Zero Covid policy, consensus growth forecasts starting to be revised up again and some sense that there will be a resolution to Ukraine this year. This rebound might continue.

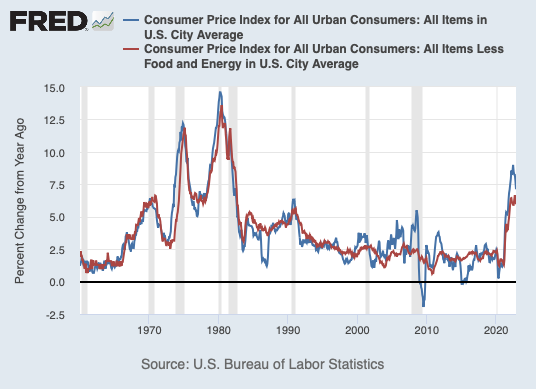

Investors and business leaders are particularly sensitive to the inflation outlook because high interest rates for longer could spark off future financial crises with debt levels so high, and so many zombie institutions out there facing high debt service costs. The consensus appears to be that we have passed the worst of inflation and central banks will stop raising rates this year. The Fed expected that inflation would peak in 2022, commence declining in 2022 and then hit its 2% target in 2025. My former employer Morgan Stanley explicitly forecast that inflation would peak out in the fourth quarter of 2022. Goldman Sachs economics team expect the core PCE inflation (to which central banks say they pay most attention) will drop significantly in 2023. And after the latest print of US inflation being lower than expected , certainly the camp that believes the inflation was transitory might win for the time being.

Future Shock will likely Strike Again

“The future always comes too fast and in the wrong order.”

― Alvin Toffler, author of Future Shock

Whilst things look a little rosier now, I think that investors and decision-makers are likely to be blind-sided yet again by the future in the 2020s; there are just too many paradigm-breaking incoming waves which they are not trained to discern. For the rest of the decade it’s likely that inflation will take off again as the tectonic forces I identified entering the new decade, are still very much in play. Many of these are supply side shocks and hence central banks cannot do much against them – and when they do take action, they threaten to spark off recessions without addressing the underlying causes. So whilst the second derivative (the rate of change might well see ebbs and flows), do not be surprised to see future periods of high inflation.

These are some of the tectonic forces I observe which will continue to mean that inflationary risks are to the upside:

Debt has been rising for some time, but after some of the largest interventions ever in history, global debt now stands at over 350% of global GDP. The largest economy in the world, the USA, has debt to GDP levels higher than peak debt during both the Depression and coming out of WW2. For many governments around the world, the path of least resistance will be the so-called inflation tax as they will not want to raise taxes or cut budgets. And whenever governments want to spend more they have got into the habit of monetising the debt by encouraging central banks to buy their debt.

Demographics are worsening as most of the world is ageing and population pyramids are not inverting. Major economies around the world such as Japan and Korea are actually seeing populations decline. China just announced this week that the population fell 850,000 in 2022, the first fall in 60 years. Europe is not far behind. This has economic consequences and in fact is a future debt time bomb. In 1960 there were 5 workers per retiree/disabled worker in the USA. By 2009 that ratio hit 2 and we are rapidly approaching 2:1 by 2030. Consequently there is a growing shortfall in pensions: for the top 20 economies of OECD are about $78 trillion

Deglobalization is the reversal of what we have seen unfold since the end of WW2, especially after China began to open in the 1970s (culminating in its admission to the WTO in 2002) and the fall of the Berlin Wall in 1989. Corporations moved their facilities to nations with the lowest cost of production and China became the factory of the world. In fact, between 1995 and 2019, just pre-pandemic, the durable goods component of the CPI fell an incredible 40%. So China was exporting deflation for some time. However, this era has ended with China considered a strategic rival (at least), governments in the West will continue to pressure companies to invest elsewhere; what is now being called friend-shoring or on-shoring. This has only just started in earnest: many businesses have sunk costs in China or still want access to its markets. The FT is currently running a series describing how tricky (costly?) it will be to extricate itself from China. However, national security concerns will ultimately trump this as China has been rivalling the West on key technologies including 5G, AI, renewable energy, nuclear fusion and quantum computing and communication. The unravelling of Chimerica and global supply chains will be very costly indeed.

Even if globalisation has not ended but is merely morphing in form, with its latest incarnation happening in the form of greater Eurasian integration and the New Silk Roads, this will still imply inflationary forces in the Western economies with the creation of a bipolar world.

Discord refers to the shift from a unipolar world to a multi-polar world which is being vehemently resisted by the US and the West. There are major geopolitical rifts between the West and China and the West and Russia which can explode into proxy wars (like Ukraine) or direct wars at any moment. As we have seen with Ukraine, this can add a geopolitical premium to energy costs but also directly distort supply of important commodities including energy, chemicals like fertilisers, and food. Some commentators think that the war will be won by the West soon, however the risks are that with NATO putting tanks and special forces into the arena, events might explosively escalate. China is also fairly clear that it wants Taiwan to rejoin the mainland. Energy costs are off their peak but partly this is due to the warm winter in Europe. This year one would expect the race for energy security to continue.

Domestic division is rising across the world and especially in the major economies. In some ways domestic social unrest, discord and even coup d’etats might continue to be more probable than all out war between nation states. I would expect more events like January 6th on Capitol Hill. This is being driven by income and wealth disparities, a general feeling of unfairness, a collapse of trust in institutions including government, mental health declines and the culture wars (in the West at least). Internal war can result in lost production, rising costs, and encourage governments to appease their populations with greater spending, which is inflationary itself.

Disease in the form of COVID-19 and especially the government response to it can be incredibly stagflationary as we witnessed in the past several years. Workers are forced home, borders are disrupted, and supply chains can break down. In my opinion, despite the tragic loss of life, Covid was actually a fairly mild pandemic and we could easily be struck by a disease with a much higher fatality rate.

Destruction of our planet might be one of the greatest drivers of inflation especially if not dealt with preemptively. Experts tell us we should already be spending $5 trillion per year on climate investment. As some readers might know, I see this as a much broader ecological crisis when we include all aspects of the biosphere including biodiversity. Weather events, storms, drought and ecosystem collapse will incur immense costs and likely raise food costs further. A Nobel economist, Professor Nordhaus of Yale, has calculated that a carbon tax should be priced at $200 vs current price which can be as low as $1 or $2 in some markets. Ultimately, large investments will be made awned we will restructure our economies, making them far ore resilient and regenerative which will be good for all living things on the planet.

These forces will mean that interest rates are unlikely to be as favourable as they have been for the last 40 years of investing. Of course, when recessions turn into hard landings central banks will probably blink and cut rates again. During the stagflationary 1970s, rates oscillated considerably even though they peaked at 15% under Fed Chair Volcker. But they might struggle to cut them as low as they did before.

This might be the biggest shift in the investment backdrop in my 34 years of observing economies and markets. And I am not alone saying this; a number of contrarian investors from Howard Marks to Marc Faber seem to concur about this sea change. However, this should be no surprise given that as a futurist I believe humanity is undergoing the natural disruption which would come with a revolutionary moment like the Agricultural Revolution or the first Industrial Revolution. Ultimately this will be a good thing; the economist Schumpeter, in the 20th Century, wrote about the necessity of creative destruction in our evolution.

So I insist on ending on a positive note. What we might be witnessing is the final and necessary disintegration of the Industrial Age, or even the end of our current civilization. So my final ‘D’ is ‘dawn’ which points to the dawn of a new technologically-advanced, ecological civilization about which I will be delighted to write more.

Benjamin J Butler is a global futurist, economic consultant and writer. He acts as Futurist for Horasis and sits on numerous advisory boards around the world.