Fintech Innovation Gives New Hope

Financial inclusion has been a pressing problem in emerging economies. Traditional financial institutions have been slow to extend services in rural and remote areas. As a result, many have remained outside the purview of formal banking channels – a trend that has also ensured slow economic affluence for large subsets of emerging economy populations.

However, with new financial technologies—particularly fintech—there is much needed disruption in the financial services sector. Fintech services are shaping how services are provided worldwide. In addition to the breakthroughs being made, how can we ensure these services are easily accessible and deliver value and efficiency to all parts of society, especially the underprivileged? In particular, what lending solutions will make financial products more accessible to both small enterprises and entrepreneurs?

To address such pressing concerns, Horasis is organizing the Horasis Global Meeting on 08 June 2021. The one-day virtual event will see participation from a diverse range of people, spanning members from governments, businesses, academia, and the media to deliberate on issues that undermine progress in emerging economies and to arrive at solutions that can ensure prosperity for the world.

Fintech a Revolutionary Force

The introduction of smartphones, coupled with inexpensive data plans has brought hope to millions. Thanks to proliferation of smartphones, financial services can now be availed by a click with a device that fits in the pocket. Fintech platforms have eliminated the need to visit physical locations to access banking services, offering great convenience to rural and remote populations. Fintech platforms have revolutionized lives, and more importantly, spurred the growth of small businesses.

It is widely acknowledged that small businesses make the world go round. SMEs employ the bulk of populations worldwide, yet they faced a lack of access to credit. Banks and other traditional financial institutions typically view small business as risky propositions due to their lack of credit history or meagre cash flows. This has often led small business owners to take credit from informal finance channels at high interest rates.

Currently, however, there are several app based micro lenders. Algorithms are being used to determine credit worthiness, with borrowers uploading all relevant documentation digitally. Fintech platforms almost entirely eliminate the need to visit a physical branch. Credit approvals, likewise, can be processed in shorter turnaround times than traditional banks. Giggle Finance, Fundbox, and Kabbage are popular online creditors known to approve a credit application in as little as three minutes – bringing relief to a large section of society.

Added Benefits

Most small business owners have to juggle multiple roles and when accounting is added to the list of responsibilities, chances are it will only prove overwhelming. However, the use of a fintech platform can make managing cashflow easy. Many fintechs integrate accounting in their systems, empowering the business owner to make informed decisions – from determining when to make investments to securing a loan, and from placing orders for fresh inventory to understanding when to hire employees. Simply put, the owner is better positioned for success and there is always potential for growth when there is sound understanding of business cashflow.

Furthermore, the pandemic increased the uptake of digital payments. E-wallet usage surged worldwide and it is imperative for SME owners to incorporate digital payments in their businesses. Yet again, this convenience is made possible by most fintech platforms. SME owners have also been encouraged to establish online presences through webstores and social media usage. In these instances, too, digital payments are the order of the day. Well established fintech platforms such as Stripe, PayPal, Circle, and Venmo, among others, have made online payments easy, simple to use, and are also secure methods to transact.

Fintech is Exploding

The pandemic and ensuing lockdowns have dealt a blow to most businesses. In these trying times, it is all the more necessary to increase technology uptake. Furthermore, it is only prudent to reap the benefits that fintech platforms offer and use these tools to grow small business operations into robust, sustainable, and long-term projects.

With security breaches becoming commonplace, fintechs are increasingly equipping themselves to defend against cyberattacks and protect valuable data. Blockchain technology is fast making inroads and this technology breakthrough promises to make online transactions more secure and less expensive, all while ensuring minimal transaction times. Fintech has burst on to the scene. It is here to stay; it’s adoption by all is only a matter of time.

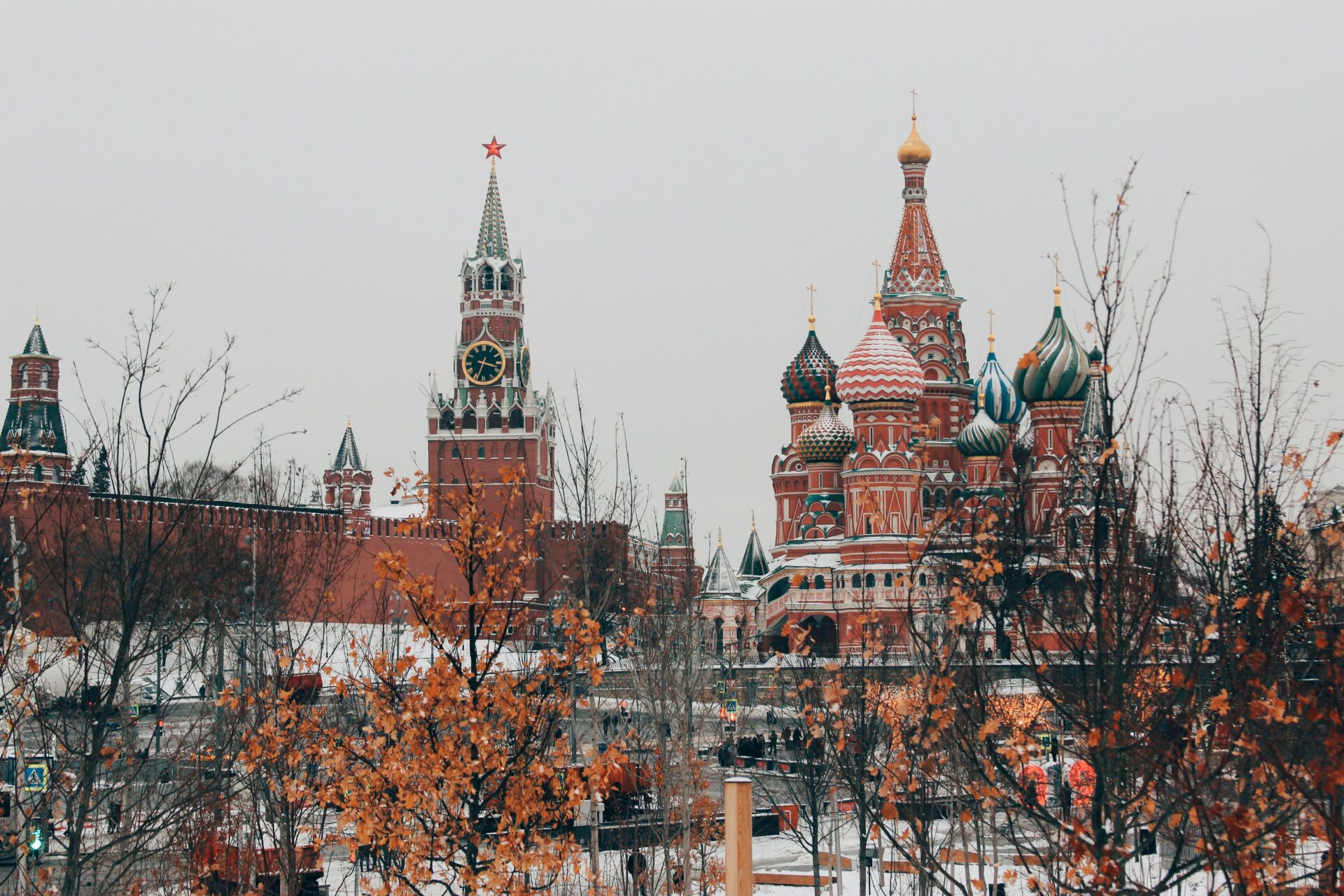

Photo Caption: Fintech has helped reach some of the remotest corners of the world, in the process driving financial inclusion.