The platform revolution in 2021

2020 was a pivotal year for the platform economy. The sudden onslaught of the pandemic upended entire industries like movie distribution and grocery retail. The need for contact tracing to counter the viral spread legitimized surveillance at an unforeseen scale. BigTech firms marched in to transform the economics of several more industries, most notably healthcare and financial services. Incumbents like Reliance rewrote the playbook for partnering with BigTech firms. And the platform economy demonstrated its very own K-shaped recovery, further exacerbating inequality between above-the-algorithm actors and below-the-algorithm actors, as we observe further.

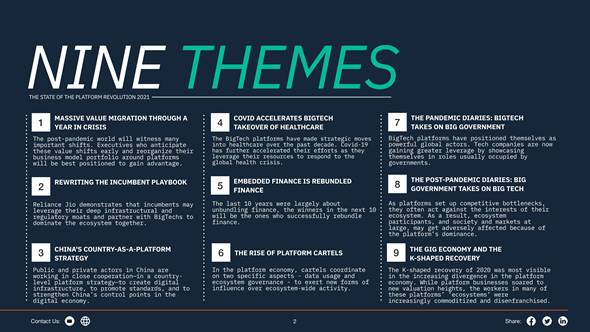

As we move on to 2021, nine key themes that emerged in 2020 will play an even stronger role in 2021. The full 90-page report on this topic may be accessed here but this article presents a summary of nine key themes that will define the platform revolution in 2021.

Let’s dive into a quick overview of these themes.

Theme #1: Value migration transforms industry economics

The keys to transformation beyond a crisis may often lie in new value pools created through the crisis. Times of crisis are accompanied by sudden changes in supply-side and demand-side dynamics. These changes lead to the migration of value from established business positions to new ones, enabling new players to emerge and new business models to be created. Such migration of value is also accompanied by a shift in value network control points. This value migration commoditizes some business positions and empowers others.

To understand this migration of value, we need to start by identifying key trends impacting a value space. These trends may be classified into demand-side and supply-side effects.A combination of demand-side and supply-side effects helps us determine the emergence of new value pools.

Next, we need to determine whether shifts in value will be accompanied by shifts in control points. Control points refer to control of key assets, relationships, and data flows in a value network. Firms that emerge stronger from a crisis are those that can respond swiftly to a shift in control points.

———

Since the start of the coronavirus pandemic, we’ve seen such a phenomenon play out in the movie distribution industry. Streaming platforms like Netflix and Amazon Prime have witnessed a surge in engagement during lockdown.

However, this seemingly transient shift in demand-side behavior is reinforcing a much more permanent supply-side shift.

The closure of major theatre chains, owing to the pandemic, is driving studios to break what’s known in the industry as the “window” – the three-month period between when a movie hits the big screen, and when it’s offered for video on demand purchase or rental, and then on streaming devices. This “window” that movie theatres have to launch movies exclusively, is a moat protecting theatre revenues.

All through 2020 – and now on to 2021 – studios have launched directly on streaming channels, thereby eroding the “window”.

Value migration was our theme of choice for this year. We’ve seen massive value migration in the usual suspects – Movie distribution, food delivery, grocery.

But we’ve also seen this play out in financial services and healthcare, as we explore further in the themes below. The report unpacks the economics of value migration and where we might see it next.

Theme #2: Rewriting the incumbent playbook

During the pandemic-ravaged summer of 2020, many of Silicon Valley’s top tech giants (and leading investment firms) invested more than 20 billion dollars in Reliance Jio, a seemingly traditional telecom company in India. Over the course of 14 weeks, the company raised capital from Facebook, Google, Intel, Qualcomm, and a host of investment firms.

This was all the more confounding because Reliance was essentially playing a traditional telecom game and building an asset-intensive business. Since the mid-2000s, the telecom industry has been impacted by two waves of disruption, first when Apple and Google built their app platforms and next when Skype, WhatsApp, and other providers of free communication services eroded traditional telco revenue streams.

The response of telecom operators to these shifts have been predictable, with some trying to directly copy the new business models, while others resort to competing among themselves, launching aggressive price wars. None of these responses acknowledged the new competitive landscape, as telcos grew increasingly commoditized.

That is, until Jio came along.

Through a combination of moves, involving a $30Bn+ investment, Jio rewrote the economics of the telecom industry in India.

This theme provides a deep-dive into Jio’s strategy and its eventual impact on the traditional telecom industry power structure. Doubtless, this was one of the biggest platform stories of 2020, even as many incumbents bemoaned their inability to execute a platform strategy.

Theme #3: Using platforms to gain geopolitical leverage

As platforms continue to grow, control over the trade in goods and services is shifting from countries to digital platforms. And as trade, labor, and money grow increasingly digitized and are exchanged on platforms, countries need to rethink their positions in the global flow of these goods. If they are to gain a competitive advantage, countries need to increasingly pursue a platform strategy.

No country is doing this as effectively as China, which in recent years has set up a concerted country-as-a-platform strategy,

(1) aggressively exporting its digital infrastructure,

(2) playing a critical role in the development of technical standards, and

(3) developing unique points of control in the digital economy.

China has been following this playbook with Alibaba’s movements in trade:

And there’s a similar playbook at play in global payments:

Urban infrastructure is a third key segment as China extends its bid to embed its ‘operating system’ across the Belt and Road cities:

This theme dives deep into China’s four-pronged strategy to gain geopolitical leverage in the platform economy.

Theme #4: BigTech platforms set up market bottlenecks and industry infrastructure in an increasing number of new industries

The healthcare industry architecture is becoming more modular, unbundling healthcare delivery from traditional care facilities.

Despite the unbundling, the lack of data interoperability – e.g. Electronic Health Records (EHRs) interoperability – has created a fragmented patient journey, as patients cannot easily port their data from one provider to another, or integrate data from wearables with their EHR data. Despite greater consumer choice, the coordination costs to drive end-to-end patient care increase.

However, as explained in detail in the report, two key shifts – increasing data interoperability and improvements in AI and machine learning – are driving down coordination costs, leading to the rise of platforms in healthcare.

Apple, for instance, is pursuing a platform strategy centred around the Apple Health Record. Apple’s Health Record aims to be the central health record for users, combining data from acute care – currently stored in EHRs – with data from a variety of wellness and disease management devices and services, using FHIR-based integration. Apple’s partnerships with health systems and EHR vendors enable it to integrate EHR data with the Health Record. Apple also partners with Health Gorilla, a clinical data API exchange, to integrate diagnostic data.

Google’s platform strategy involves provisioning clinical and operational infrastructure that underpins production across healthcare operations, diagnostics, drug R&D, surgery, and claims management. Google’s DeepMind enables access to diverse, siloed data in a standardized format, enabling a wider scope of data elements to be analyzed for clinical decision making. Google’s infrastructure platform also includes capabilities like DeepVariant, which provides an open-source deep learning tool for genomic analysis, aimed at the life sciences industry.

The report dives deep into the platform strategies pursued by Apple and Google in healthcare, while also highlighting Amazon’s contrasting play. More importantly, it highlights how platforms enter new industries either by creating market bottlenecks or by replacing traditional industry infrastructure (or both).

Theme #5: Startups rarely capture value while unbundling, BigTech platforms concentrate value through rebundling

The last 10 years were largely about unbundling finance, the winners in the next 10 will be the ones who successfully rebundle finance.

Fintechs began by “unbundling” financial services. They identified one traditional banking function, and executed it with finesse. However, unbundling creates a fragmented customer journey and increases search costs for consumers. The next decade will be dominated by financial services players that can successfully “rebundle” services to cater to the evolving financial needs of its customers.

The report explains the economics of unbundling and rebundling and looks at strategies followed by Ant, Stripe, and Square to create and concentrate value across ecosystem activity.

Theme #6: The pandemic provides centrestage for BigTechs to play BigGovt

The devastating consequences of the virus outbreak overwhelmed the resources of administrations across the world. The COVID-19 crisis led to a sudden and major shift to telemedicine and virtual learning. Though public health and telemedicine are usually considered the government’s statutory function, Big Tech shared the responsibility.

Amazon and Google stepped in to provide critical infrastructure for the pandemic. AmazonFresh enabled customers to avoid physically going to the supermarkets. In April 2020, Google and Apple made it clear that they would pause their long-held rivalry and work with nations to create a new contact tracing infrastructure. They reconfigured their mobile operating systems to let users know if they are in the vicinity of a device held by a COVID-19 patient.

In particular, Big Tech made its influence clear in three key areas.

Stopping misinformation

Content platforms reinforced their role as information mediators by combating spread of misinformation.

Helping in pandemic response

Big Tech platforms responded to the pandemic by providing data commons and analytical capabilities, aiding research by sharing these resources.

Stimulating a robust economic ecosystem

BigTech also left its mark in stimulating economic activity. Apple Music started a $50M COVID-19 advance fund for Indie labels. Facebook announced a $100 M investment to support the news industry. Google started providing around $300M as Google Ads credit for small and medium businesses. These efforts revive the economy by primarily activating their existing ecosystems.

The report dives deeper into this theme and the potential conflicts of interest this creates, giving platforms greater lobbying power in the long run.

Theme #7: Regulation accelerates towards the end of 2020

Platform regulation is heating up. No platform roundup would be complete without explaining the dark side of the platform economy and the need for regulation.

Regulation has picked up steam through the second half of 2020, with several key developments kickstarting in December 2020.

In the report, this theme covers four key topics:

- The dark side of platform dominance

- How moving fast and breaking things combined with archaic antitrust laws have let BigTech platforms run unchecked far too long

- Various schools of thought on platform regulation

- Design principles for platform regulation and unintended consequences of over-regulation

Theme #8: The rise of platform cartels

We’ve seen many examples of cartels in the traditional world of pipelines. Traditional cartels coordinate and collude on a range of aspects, most often price and output, but also standards and patent usage.

In the platform economy, cartels coordinate on two specific aspects: data usage and ecosystem governance.

In this manner, they impact not just traditional production metrics like quotas and prices, but effectively exert new forms of influence over ecosystem-wide activity, including influencing the decisions and actions of third parties not involved in the cartel, as the examples below show.

Coordination in platform cartels is achieved through data sharing and technology standards. This essentially enables automation of all coordination allowing platform cartels to be much more responsive and adaptive to external forces than traditional cartels, which relied on agreement by committee and contract.

Finally, platform cartels further exacerbate antitrust concerns. If individual platforms gain near-monopolistic positions through network effects, cartelization further centralizes power with the top players.

The report explains the rise of platform cartels in information management and in contact tracing, among others.

Theme #9: The platform economy becomes the poster child for pandemic-driven inequality

One of the most visible manifestations of the K-shaped economic recovery of 2020 is the increasing divergence in the platform economy. While platform businesses didn’t just recover but soared to new valuation heights, the workers in many of these platforms’ ‘ecosystems’ were increasingly commoditized and disenfranchised. Worker classification as contractors coupled with increasing algorithmic control of their work leaves them with the worst of both worlds. Platform work often combines the constraints of employed work (lack of free agency) with the disadvantages of being an independent contractor (poor access to benefits).

This is a topic I’ve looked at extensively over the years, particularly as part of my work with the International Labor Organization and while advising several member states of the EU on the topic of platform work.

Above-the-algorithm workers – Programmers and coders in the platform company – have access to a wide range of data flows about the ecosystem and analyse these data flows to inform the design of algorithms that manage the ecosystem. This allows platform programmers to alter the working of the algorithms to optimise market outcomes by studying below-the algorithm workers – drivers, food delivery agents etc – and their behavior, and imposing specific policies in response, either as explicit policies or encoded into their algorithms.

However, the workers who are managed by these algorithms have near-zero visibility into the working of these algorithms. Workers would benefit from understanding the variables prioritised by an algorithm, but are not given such visibility. While the platform company can alter its algorithms in response to worker behavior, workers find it much more difficult to appropriately adjust their behavior in response to changes in the platform’s algorithms. This information asymmetry further empowers the platform and disempowers workers.

For all the doom and gloom of 2020, a few important developments through the year have begun to shift the balance back in favor of workers.

The report dives deeper into these issues and explains how platforms commoditize their ecosystem members and centralize power away from them, while radiating risks to these ecosystem actors.

You can get a copy of the full 90-page report exploring these themes here.

About the author: Sangeet Paul Choudary is the co-author of the international best-seller Platform Revolution and the founder of Platformation Labs, a C-level advisory firm that advises Fortune 500 firms globally. Sangeet is a speaker at the upcoming Horasis Extraordinary Meeting for North America