India, Vietnam and Global Economic Outlook

The US-China trade war greatly impacted global trade. While the US and China began taxing each other’s traded goods, other countries seized the opportunity in increasing their exports to the US and overall global trade increased.

The war that began in 2018 is yet to recievemresulted in a total loss of US$550 billion in import tariffs, the majority of which is aimed at Beijing.

Furthermore, the onslaught of the pandemic since the beginning of 2020, resulted in large economic losses. At the height of the pandemic, the World Bank estimated a 5.2% contraction in global GDP in 2020 – the deepest global recession in decades. The pandemic also triggered contraction in per capita income – a fall by 2.5% in developing economies and by 7% in advanced economies. Most economies will also face severe recessions, with long term damage to output and economic growth.

India and Vietnam are among the bright spots in a generally dismal global economic outlook. This is one of topics in the upcoming Horasis India Meeting, being held between 25 to 26 September, 2022 in Vietnam. The themes will center around geopolitics, impacts of COVID-19 and the pressures being faced by global and national economies in their path to recovery. The event will have 300 of the most senior members of Horasis, suggesting ways in which developing economies—particularly India and Vietnam—can realize a sustainable and resilient future.

Coping Mechanisms

At the height of the pandemic, emerging economies, particularly those in Asia, Africa and Latin America were impacted the most. To control the spread of the unknown flu at the time, most nations shut their borders. This greatly disrupted trade, both within the region and internationally.

Movement of critical goods, although permitted took much time to arrive due to strained supply chains. Social distancing measures resulted in productivity loss in industries, thus greatly impacting flow of goods and its prices.

Availability and market price of medical necessities amid the height of COVID-19 spread was difficult. Prices of masks were on the higher side, while many medical outlets ran out of handwash.

India was quick to understand that the only viable option to emerge from the grip of the pandemic was to ensure that most of its population get vaccinated. The Indian government invested around INR46 crore (US$5.75 million) on clinical trials for the development of both Covaxin (Bharat Biotech) and Covishield (Serum Institute). The government also extended an advance of 100% amounting to INR2,520 crore (US$315.52 million) to Bharat Biotech and Serum Institute for procurement of vaccine doses.

Overcoming the Inflation Shock

India’s CPI inflation rate stood at 95-month high of 7.8% in April 2022, while WPI inflation rate soared to an unprecedented level of 15.1% in the same period. This implies that the nominal GDP growth will be higher than the real GDP growth. Nominal GDP in FY22 stood at 19.4% and is expected to grow by 14.5% to 15% in FY23. This additional fiscal can be used by the country to invest in its infrastructure development and reduce tax rates on petroleum products, to reduce inflation shock.

Meanwhile, Vietnam CPI inflation has increased from 1.8% in Dec 2021 to 3.4% in June 2022, but is still below State Bank of Vietnam’s 4% target. This control in inflation prices is due to the country’s accommodative monetary policy that has ensured ample liquidity in the market, maintaining strong credit growth. But if the 4% target set by the government is crossed, then the national bank will need to tighten their monetary policy to subside inflationary pressures through hikes in interest rates and proposed cuts of value added tax (VAT) and import taxes.

To maintain the recovery momentum in both the countries, policymakers will need to be vigilant about emerging inflation and financial risks across the world. Their policies will need to be agile to the changing dynamics around global risks. In addition to this, both India and Vietnam will need to continue their structural reforms to support potential growth in the medium term, thereby making their economies more resilient and inclusive.

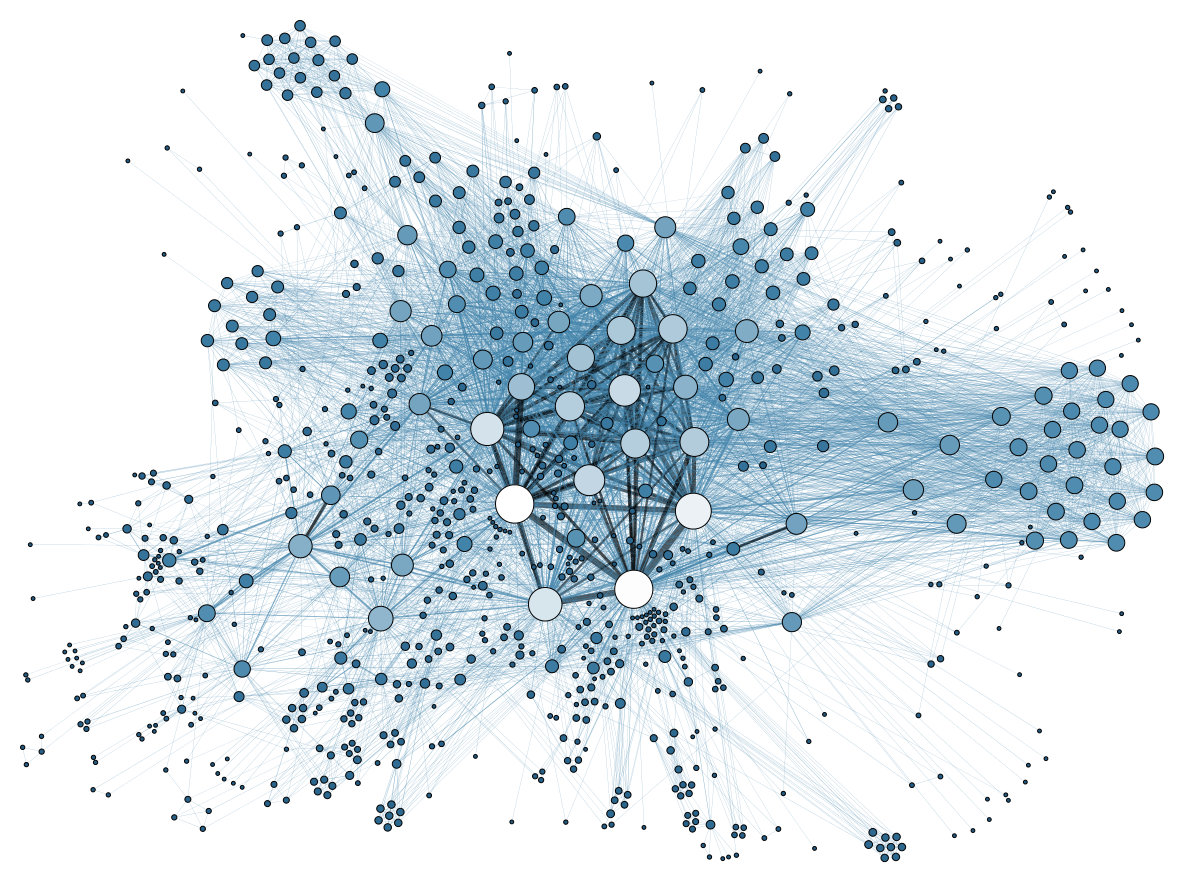

Photo Caption: India and Vietnam are among the bright spots in a generally dismal global economic outlook.