Unifying Supply Chains in China and Vietnam

The pandemic was a significant disruptor, affecting not just health, but also causing substantial disturbances in global supply chains. Its timing couldn’t have been worse, coinciding with the escalating trade tensions between China and the US.

This global health crisis exacerbated the already strained supply chains, halting global production and causing disruptions in product availability and pricing. Nevertheless, the pandemic yielded clear winners and losers. The lifesciences sector witnessed increased growth in customer demand, and were also successful in introducing new products to the market. In contrast, labor-intensive sectors were hit particularly hard, with factory owners having to invest in adapting to new requirements for physical distancing, contact tracing, and additional personal protective equipment.

Yet, not all is gloom and doom. The pandemic has acted as a catalyst, pushing supply chain stakeholders to invest in their technical capabilities; enhancing real-time visibility and resilience, while also developing agile ways to move forward.

Increasing Availability and Resilience

The present manufacturing ecosystem is flawed. Most manufacturers depend on suppliers and sub-contractors. Although this allows a lot of flexibility to product manufacturing, the primary manufacturer is left highly exposed to global risks. The pandemic was a clear example of that.

Companies should start by identifying their supply chain risks. This will require mapping their entire supply chain, including distribution facilities and transportation hubs. After the risks have been identified, companies can use this information to diversify their supply base and/or stockpile key materials.

Supply managers might consider developing a regional strategy that involves producing a significant share of essential goods within the region of their consumption. To safeguard their global market presence, Chinese companies are already exploring neighboring countries like Vietnam for their production needs.

Many Chinese manufacturing firms, from labor-intensive textile companies to high-tech communications and photovoltaic firms, are building factories in Vietnam, to avoid risks and get around trade barriers. Some are already supplying all their international orders from their Vietnamese plants.

This shift bodes well for Vietnam’s economy. China-based DBG Technology, an electronics manufacturing services provider plans to hire and train about 15,000 Vietnamese people for its Vietnam unit. The company also has plans to establish an omni-industrial chain, supporting local procurement in the Thai Nguyen province in Vietnam.

Supply Chain Rebuilding

China has been taking several steps to rebuild its supply chain post the pandemic. Local governments in China are sending new business delegations overseas to shore up export orders and reinitiate business linkages, post China’s zero-COVID closures. China’s government is also providing subsidies, covering flight and hotel expenses for Chinese business delegates, even going to the extent of ensuring smooth visa application process and guaranteed return flights.

After China ended its zero-COVID-19 policy in December 2022, the initial 50 days of 2023 saw Chinese companies initiating 45 new ventures in Vietnam, marking the highest investment from a single country. Notwithstanding, the consequent decline in foreign investments globally, Chinese firms have significantly increased their expenditure on new building projects in Vietnam. The spending has tripled to $250 million as of March 2023, compared to the same period a year earlier.

This year’s Horasis China Meeting, scheduled for 14 to 15 April 2024 in Binh Duong, Vietnam will showcase the partnership power that both these Asian nations can tap into to further their trade and supply chain interaction. The meeting will bring together 300 of the most senior members of the Horasis Visions Community, including some of China’s and Vietnam’s best known business leaders.

Vietnam Continues to Attract

Vietnam’s extensive economic integration is remarkable. By the middle of 2023, Vietnam had forged economic and trade ties with approximately 224 partners across various countries and regions. This scenario presents favorable opportunities for Chinese enterprises operating in Vietnam to broaden their market footprint.

There are several reasons why Chinese companies are progressively broadening their operations into Vietnam. One primary reason is the shared border between Vietnam and China, which simplifies the transportation of commodities, raw materials, and production lines. Additionally, the Northern part of Vietnam is particularly attractive due to its geographical closeness to China and its competitive industrial land lease rates when compared to the Southern region.

The varied geographical landscape of Vietnam, which includes mountains, plateaus and coastal regions, is ideally suited for the creation of comprehensive economic zones. The country is home to a substantial workforce, inclusive of skilled labor, providing highly competitive labor costs. Furthermore, to lure foreign investors, the government has rolled out a series of tax benefits.

Perhaps China’s President Xi Jinping’s speech to the Vietnam parliament in December 2023, sums up the future of the China-Vietnam relationship. He announced “the establishment of a strategic China-Vietnam community of ‘shared future’ to promote the upgrading of China-Vietnam relations.”

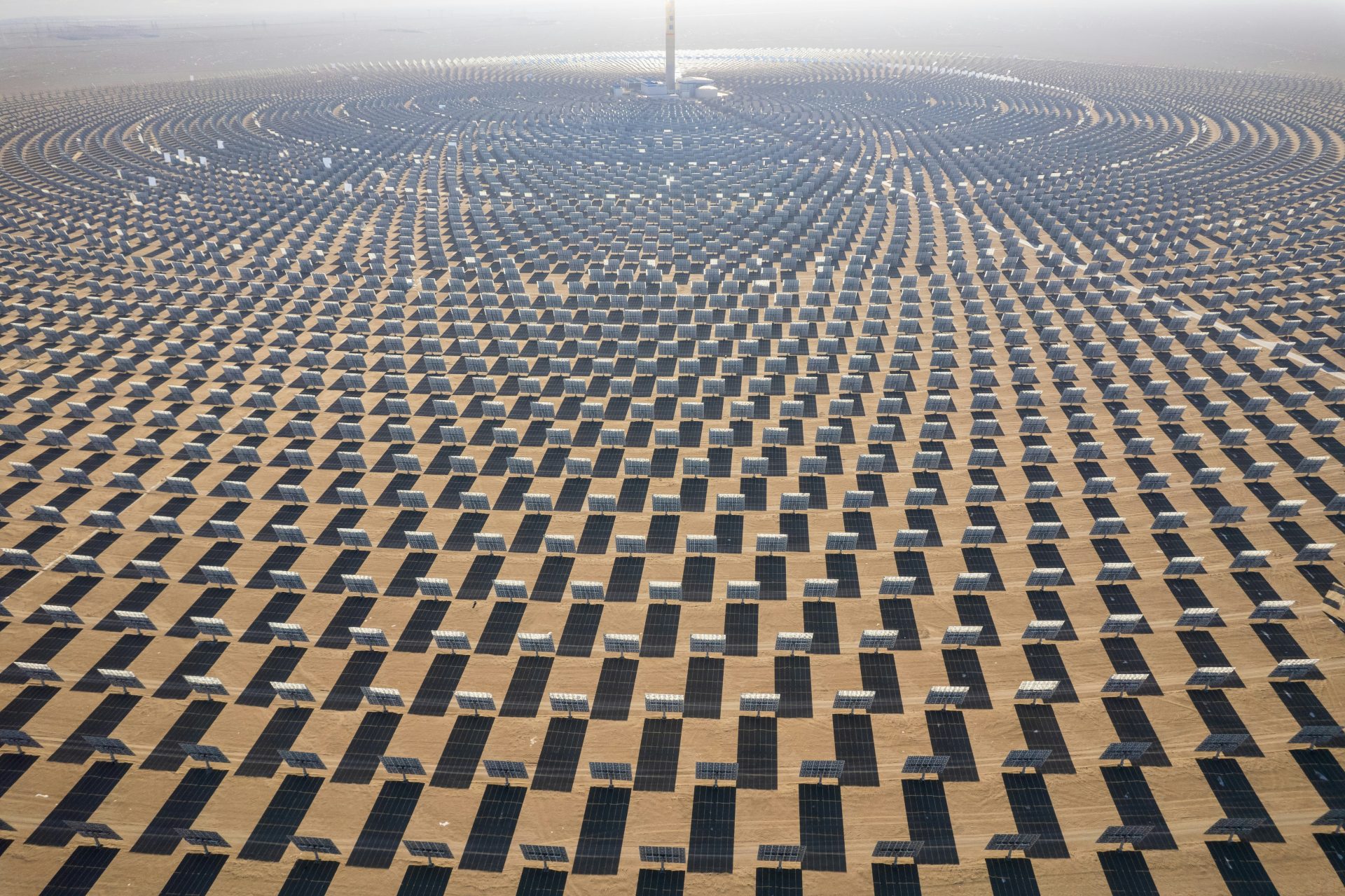

Photo Caption: A Chinese textile manufacturing company in Vietnam.